The time is now for Cloud ERP

Driven by ongoing disruption, customer demand and competitive necessity, many small and medium-sized businesses (SMB’s) have turned to Cloud ERP in a bid to streamline their operations, increase productivity, control finances and elevate their customer experience. A recent Forrester survey of APAC SMBs found the penetration of Cloud ERP to be substantial, with continued adoption planned over the next two years1. The Forrester study shows 67% of SMBs surveyed had already deployed Cloud ERP, with 26% planning to adopt Cloud ERP within the next two years1.

Platform developments are already fast moving in this space. AI integrations and capabilities now provide a plethora of additional functionalities that will greatly enhance the value of Cloud ERP solutions. The market leading solutions already offer AI-powered Natural Language search features. This allows users to ask questions like “who are my fastest payers” or “how will this delayed shipment affect stock levels in Sydney?”. The potential for such developments to enhance productivity, create immediate business insights and reduce the time and overhead spent crunching numbers are almost endless. But to take advantage, partners need to keep pace with the speed of change, and ensure they are able to confidently advise their customers on use cases, and how to realise the value of continued investment.

The Forrester survey findings indicate that Cloud ERP has gained one of the highest levels of penetration into SMBs of any cloud solution since the start of the pandemic. In effect, this means if you do not offer Cloud ERP or at least the capabilities to integrate or migrate legacy ERP into the cloud, chances are your competitors are winning that business from your customers.

The market for Cloud ERP is strong, and as you read on, you’ll also find evidence of a very healthy revenue multiplier for ongoing services. To determine if Cloud ERP is a suitable opportunity for your business and your SMB customers, let’s look at the factors driving adoption, along with the business challenges and pain points addressed by Cloud ERP.

The size of the opportunity

The global ERP market is expected to grow from $32.7b to $74.6b by 2026. As the Forrester data shows, uptake of Cloud ERP has been rapid in APAC1. The regional market is expected to rocket from $11.98b in 2020 to $48.01b by 20302.

Broken down by industry, manufacturers are by far the heaviest investors, with 47% looking to purchase ERP software, followed by distributors (18%) and services (12%). Unsurprisingly, accounts/finance was identified as the most critical ERP function (89%), followed by inventory/distribution (67%), CRM/sales (33%) and technology (21%).3

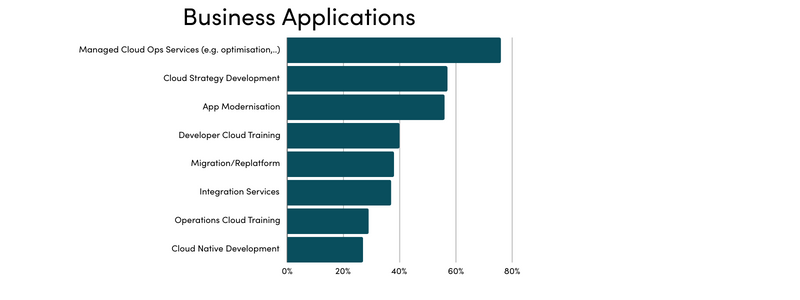

As the use of Cloud ERP grows and matures in the SMB segment, the opportunity for fast-moving partners to offer implementation, integration and ongoing services is substantial. For example, the Forrester study showed 76% of SMBs are now seeking third party services for managed cloud operations services, specifically for their business applications.

The revenue multiplier for ongoing services is significant, and worth careful consideration by any partner considering the merits of including Cloud ERP in their services catalogue.

The revenue multiplier effect for ongoing services

End-users want more from their technology partners than simply selling space on managed infrastructure and adding margin on top of software licences. Rather, they are seeking trusted advisors to guide them through their Cloud ERP enablement journey. As a result, Cloud ERP licensing revenue is dwarfed by the opportunity to provide ongoing services to customers.

In fact, IDC analysis indicates that for every dollar of revenue that Microsoft generates by 2024, partners globally will generate an additional $10.04 USD “through their own value creation” – that is, ongoing services – or somewhere around $1.2 trillion USD4.

Ongoing services range from solution design and assessments (offering a 33% average margin), application customisation (with a 39% average margin), post-sales service (53% average margin), and implementation and deployment (a 63% average margin).

Partners that can guide SMBs through the assessment, selection, implementation and ongoing operational management of Cloud ERP stands to gain healthy revenue, and competitive advantage.

Demand drivers for SMBs

Uncertain market conditions make it essential for businesses to have near real-time data, to support effective decision making and change course faster. Cloud ERP solutions equip SMBs to better manage the effects of inflation, supply chain delays and skills shortages.

Critically, Cloud ERP also supports the ability of SMBs to manage revenue growth, improve the customer experience and create a more digitally self-sufficient workforce – all three of which were identified as critical business priorities for SMBs in the Forrester survey. And with good reason, considering that IDC analysis warns that 20% of SMBs “will cease operations by 2025 because they cannot pivot fast enough to digitise their operations to meet customer demands.”

SMBs are looking to Cloud ERP to help solve common pain points including legacy systems that do not support business needs, an inability to adapt and pivot at speed, a lack of visibility and business insights, manual or inefficient processes, poor customer service, projects finishing late and over budget, poor inventory management and opaque supply chains.

End-user barriers to Cloud ERP adoption are an opportunity for third-party service providers

Commonly cited barriers to technology adoption include cost and ROI, a shortage of technology talent, complexity of legacy systems, cybersecurity and data privacy concerns, and uncertain outcomes (CPA). SMBs in particular are hampered by a lack of internal skills in Cloud tech and inexperience in managing IT vendor relationships.

But every one of these barriers presents an opportunity for savvy service providers who can address these concerns. Forrester found that 88% of SMBs are planning to increase their investment in third-party service providers, and are seeking partners who can:

- Provide an outside perspective

- Define and deliver a clear Cloud strategy

- Bring the required skills to the table

- Help modernise and migrate applications to the Cloud

- Configure Cloud platforms appropriately

- Employ pre-built software or project accelerators

- Provide ongoing management of cloud services and applications.

How to capture a bigger share of the pie

The opportunity is clear for any ERP provider keen on tapping into the vast SMB space. Our experience with channel go-to-market pathways has helped many resellers, MSPs and ISVs transform their business models, build cloud practices and win recurring revenue streams. This has earned our position as one of the most highly awarded distributors in APAC. Crayon was the winner of the 2023 ARN Innovation award in the Software category.

Contact us and let’s have a conversation.

If you want to learn more about emerging ERP opportunities, download Crayon’s eBook

The Size of the Cloud ERP Prize.1 The Future of Operations; Maximize the Value of Cloud with a Strategic Mindset, a Forrester Consulting study commissioned by Crayon, 2023. https://clicklive.rhipe.com/Future-of-Operations-Research.html

2 https://www.globenewswire.com/en/news-release/2022/06/02/2454947/0/en/Asia-Pacific-ERP-Software-Market-to-Reach-48-03-Billion-by-2030-Allied-Market-Research.html

3 ERP Survey & Profiles Of Companies That Use ERP Systems (selecthub.com)

4 https://blogs.partner.microsoft.com/partner/unlocking-the-opportunities-of-digital-transformation/